EnergyX Stock Price: What Everyday Investors Need to Know

As more retail investors explore private investment opportunities, we’re often asked, “What’s the real EnergyX stock price?”

Because we’re a private company, there isn’t a daily public quote. Instead, you’ll see our share offering price on our investor website.

In this guide, we’ll walk you through how to interpret those numbers, why private pricing behaves differently than public stocks, and which milestones we watch as we advance from demonstration to commercialization.

We’ll also touch on our technology (direct lithium production and battery innovations), where it fits in the broader lithium market, and how retail investors can participate thoughtfully.

The goal is to give you a clear understanding behind the EnergyX stock price so you can make an informed investment decision.

Who we are and what we’re building

Our mission & model

We’re building technology to unlock faster, more efficient lithium production. Our approach blends proprietary DLE systems (LiTAS®) with a broader “brine-to-battery” vision that can include licensing, project equity, and downstream refining.

On our investor page you’ll find headline program targets and the current share offering terms which reflect where we are on the journey from pilots to commercial projects.

Our technology focus (DLE, batteries) and where it fits in the value chain

Our LiTAS® process is designed to recover over 90% of lithium from brines in days rather than months, with a smaller footprint and competitive cost estimates benchmarked against legacy evaporation. We’re also advancing SoLiS™ battery work. For investors, that means our value proposition spans technology licensing potential as well as project-based lithium production.

Why “stock price” looks different for a private company

We’re pre-IPO (no daily public quote)

Because EnergyX is private, there’s no listed ticker and no exchange-driven price feed. Public finance pages that reference EnergyX will typically show company profile info rather than a tradeable price. That’s normal for pre-IPO companies.

How offering prices and secondary markets work

On invest.energyx.com, we periodically set an offering price for new shares (e.g., $10/share). Separately, accredited-investor marketplaces may show indicative secondary prices where existing holders and buyers negotiate; these can differ from our offering terms due to liquidity, timing, and supply/demand on those platforms. Think of the offering price as the entry point we publish, while secondary figures reflect what a small number of holders and buyers might match at a given time.

What you should know about share classes and liquidity

Private investments can involve different share classes and transfer restrictions. If you participate, plan for a longer holding period and understand exit paths (e.g., IPO, acquisition, or organized liquidity events). We discuss general mechanics in our investor portal to help set expectations.

Recent pricing snapshots investors ask us about

Our current offering terms on invest.energyx.com

At the time of writing, our investor page highlights $10/share as the current offering price and outlines our commercialization targets and recent updates. If you’re deciding on participation, the offering circular and FAQs on this site are the primary documents to review.

What secondary marketplaces may display (and why it can differ)

Marketplaces such as Forge and Hiive may surface indicative EnergyX pricing and, at times, a last matched price. This simply reflects that private secondary trades are case-by-case and illiquid. Secondary prints can be above, at, or below a current offering depending on timing and negotiations between specific counterparties.

How we think about valuation and per-share math

Translating valuation to an implied per-share figure

Some third-party sites model historical or estimated valuations. Those snapshots can help frame how an offering price relates to a total equity value, but they’re not a substitute for current offering documents. When looking at per-share figures, we consider fully diluted shares, warrants/options, and capital needs for the next stages of commercialization.

How future rounds and milestones may influence pricing

In private markets, milestones drive share prices more than day-to-day sentiment. As we reach technical and commercial goals, we aim to align capital formation with value creation so that new rounds reflect progress rather than just market mood.

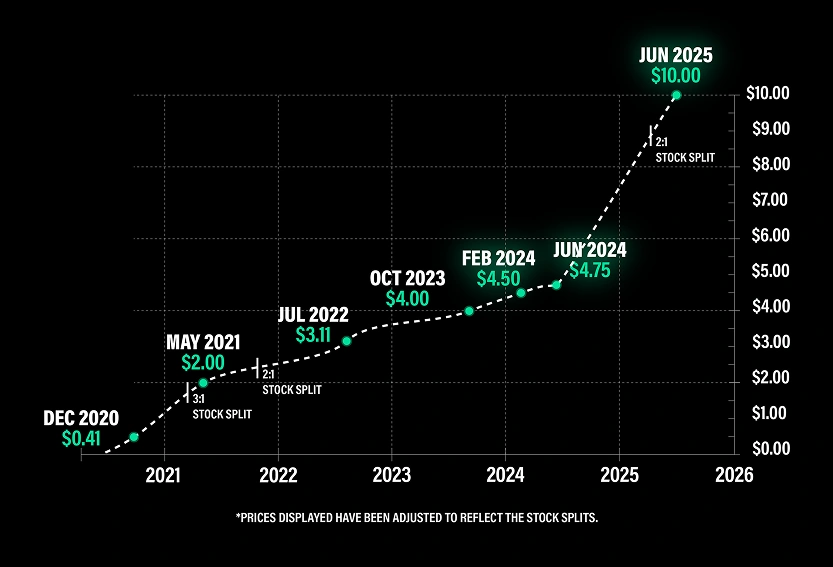

When pricing our current offering, we highlighted several inflection points that correlated with higher offering prices over time, e.g., price increases following GM’s investment, our Chile acreage acquisition, and the Project Lonestar announcement; a significant re-rating after the independent pre-feasibility study for Project Black Giant, and a stock split that set our current offering at $10/share to broaden access in this commercialization phase. As you can see from the chart below, our share price has steadily increased over time as we've reached key milestones.

The lithium market (and why we’re optimistic)

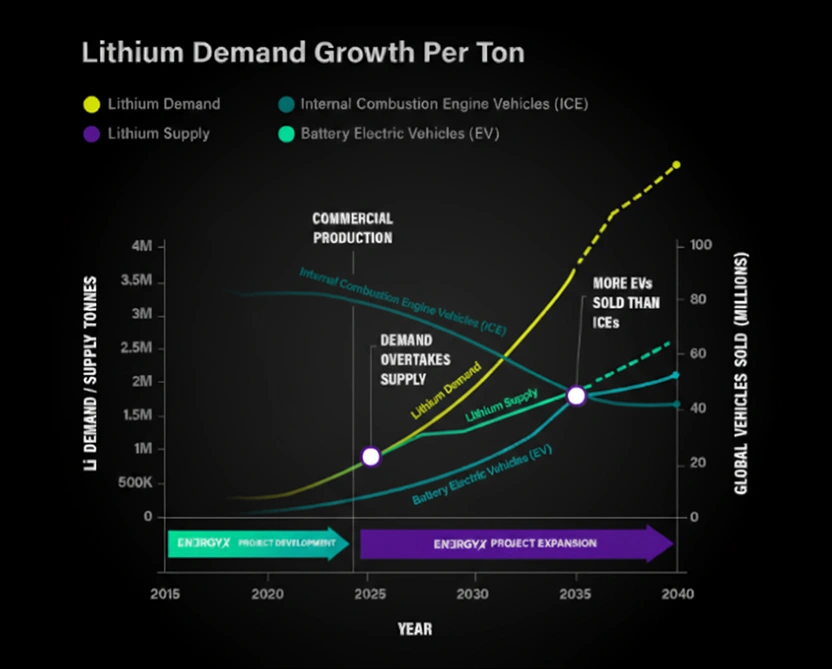

Demand drivers from EVs and storage

Independent outlets note the structural demand for battery-grade lithium, driven by EVs and stationary storage. Motley Fool’s explainer cites expectations of lithium pricing normalization while maintaining a robust long-term need for supply. That macro backdrop underpins why we’re investing in capacity and technology.

Why DLE matters (speed, recovery, footprint)

Our published materials show how DLE can accelerate brine processing and increase recovery rates vs. legacy pond evaporation, with potential operating cost advantages and much smaller land/water footprints. The goal isn’t just speed, it’s predictable throughput and consistency that can support modern supply chains.

Milestones that matter to EnergyX share value

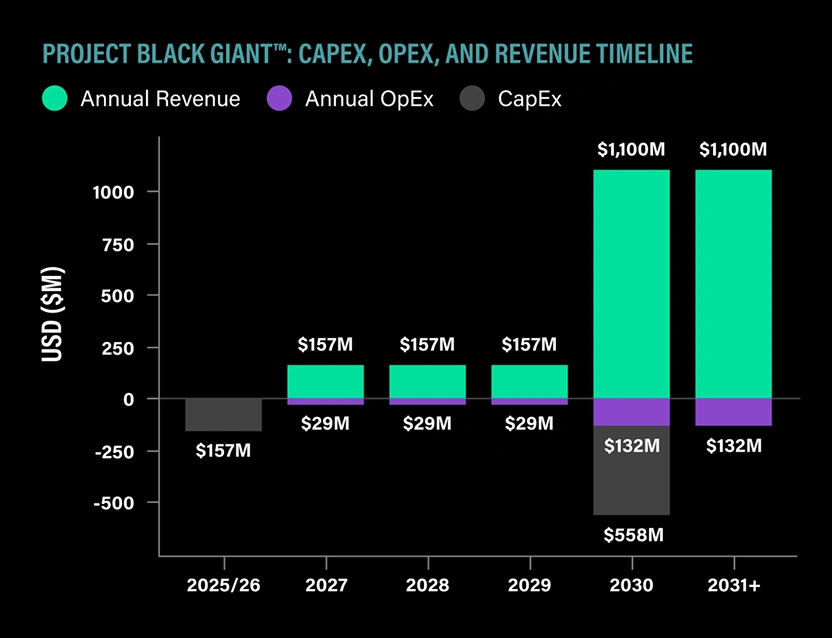

Project Black GiantTM and our Chile program

The independent pre-feasibility study (PFS) on Project Black Giant marks a key step toward commercialization. In our investor communications, we described how this milestone underpins a projected revenue opportunity and why we view it as a foundation for scaling our platform.

Project LonestarTM and U.S. Smackover plans

In the U.S., Reuters reported our Smackover acreage build-out and production ambitions (12,500 tpa by 2028; 50,000 tpa by 2030), reinforcing the domestic piece of our roadmap. Our Lonestar program is designed to translate DLE performance into North American production capacity and potential downstream processing in Texas.

Partnerships and offtake pathways

External coverage has highlighted our GM relationship among others, partners and prospective offtake arrangements help de-risk scale-up. This is ultimately about turning DLE performance into bankable commercial projects.

Accessing EnergyX shares as a retail investor

Our offering route

When an offering is open here on invest.energyx.com, we publish the current share offering price and minimum investment so interested retail investors can review materials and decide. Please rely on the official documents and FAQs on this site for final terms.

Secondary platforms and accredited-investor options

Beyond our offering, secondary marketplaces (Forge, Hiive) and platforms for accredited investors (e.g., EquityZen) may facilitate transactions in existing shares. These are illiquid and negotiated so pricing can differ from offering terms and may not be continuously available.

A practical prep checklist before you invest

Before participating in any private round, review the share class and rights, transfer/lockup terms, expected holding period, funding roadmap, and the milestones you’ll track to gauge progress. Our investor portal explains exit mechanics at a high level (IPO, acquisition, buybacks/structured liquidity).

Comparing EnergyX with public lithium/battery exposure

What’s similar, what’s different

Public peers give daily liquidity and transparent pricing; private allocations can offer earlier exposure to scale-up value creation, but with illiquidity and longer horizons. If you prefer frequent re-pricing and easier exits, public names may fit better, if you seek early-stage growth tied to specific technology and projects, a private slice can complement a diversified strategy.

Where a private allocation may fit in a portfolio

Private shares may be a smaller, higher-beta complement to a core portfolio, appropriate for investors who understand the trade-offs and can wait for milestones and potential liquidity events.

What we monitor (and what you can watch, too)

Technology KPIs

Recovery rates, uptime, reagent efficiency, and cost/ton are critical to DLE economics. We publish selected metrics on this site as programs advance so investors can follow along.

Commercial progress and project updates

Keep an eye on project updates (permits, construction, commissioning, first product). We regularly post updates on invest.energyx.com/news or the blog.

Lithium market moves

Macro lithium pricing influences project returns industry-wide. Third-party analysis suggests medium-term stabilization with long-term demand intact, but volatility can and does occur, another reason to maintain a multi-year view.

Key considerations (time horizon, liquidity, structure)

Holding periods and exit paths

Private shares are designed for long-term holding. Exits typically occur via IPO, acquisition, or structured programs. It’s important to align your expectations with that reality before investing.

Rights you should understand

Not all shares are identical. Review class, voting, information rights, and any anti-dilution or pro-rata features that apply. When in doubt, consult the offering circular and your advisor.

Conclusion

When people ask us about the EnergyX stock price, we remind them that private pricing works differently: you’ll see an offering price here and, at times, secondary indications elsewhere.

Both are valid in their respective contexts. Neither behaves like a public market quote. What matters most is the link between technology performance, project execution, and the milestones that define our path from demonstration to full commercialization. That’s where we focus our time and capital.

If you’re a retail investor with a long-term view who wants exposure to direct lithium production and downstream battery materials, a private allocation can complement your broader strategy. Our door is open: read the materials, ask questions, and decide whether participating at the current offering price aligns with your portfolio goals and risk tolerance.

Frequently Asked Questions

- Is there a real-time EnergyX stock price I can check?

Not in the public-market sense. We publish our share offering price on invest.energyx.com; secondary platforms may show indicative private trades that can differ. - Why might a secondary quote differ from your offering price?

Secondary trades are negotiated and illiquid; timing, demand, and seller needs vary. Our offering reflects current terms for new investment into the company. - What milestones are most relevant to valuation?

Independent studies (like PFS), project development (Chile, Smackover/Texas), and commercial agreements/offtake. Third-party reporting has covered our U.S. acreage build-out and production goals. - How can retail investors participate?

When open, you can participate directly through our offering here: invest.energyx.com.

- What long-term market factors should I watch?

Lithium pricing, EV adoption, and DLE adoption rates. Independent commentary suggests a supportive long-term demand picture despite near-term volatility.